The Internal Rate of Return Method. Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows.

Internal Rate Of Return Irr A Guide For Financial Analysts

Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows.

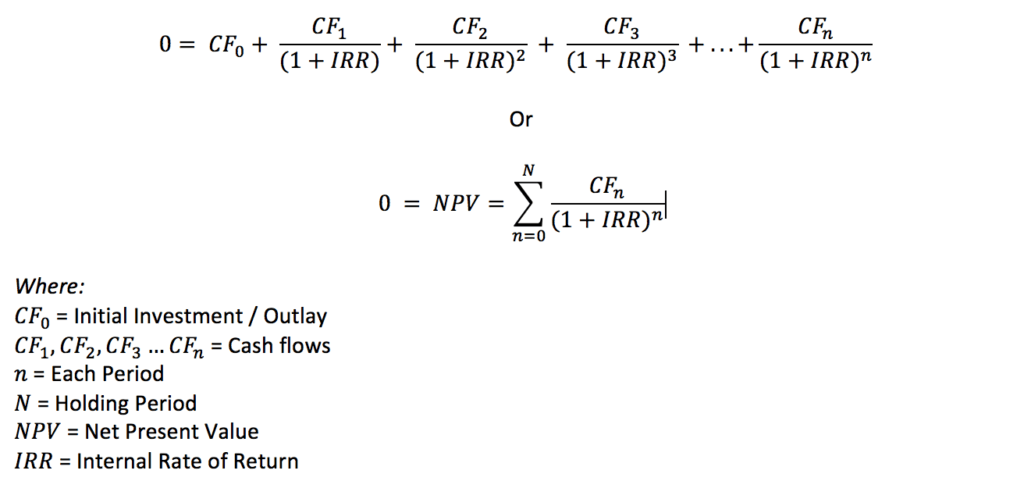

. We can describe IRR on a project as the discount rate that causes a projects aftertax income to equal zero. Required by the projects investors. Corporate Finance Create a 350-word memo to management including the following.

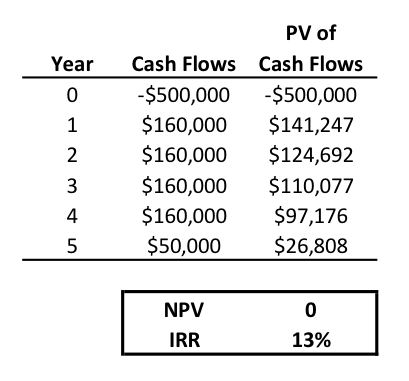

Internal rate of return IRR is the percentage of returns that a project will generate within a period to cover its initial investment. An IRR higher than the discount rate signifies a profitable investment opportunity. The modified internal rate of return for the project is 1702.

It is attained when the Net Present Value NPV of the project amounts to zero. Purpose of Assignment The purpose of this assignment is to allow the student to calculate the project cash flow using net present value NPV internal rate of return IRR and the payback methods. That results in the company being able to meet interest payment obligations.

Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows Purpose of Assignment The purpose of this assignment is to allow the student to calculate the project cash flow using net present value NPV internal rate of return IRR and the payback methods. So we are making between 11 and 12 on. In other words internal rate of return is the discount rate at which a.

In order to determine the investment viability of the project the figure may be later compared with the expected return of the project. More How the Financial Management Rate of Return Works. But instead of relying on external data the IRR is purely a function of the inflows and outflows of that project Net Present Value And Internal Rate Of Return 2017.

The cost of capital is compared to the internal rate of return promised by a project. The internal rate of return IRR is a metric used in financial analysis to estimate the profitability of potential investments. Internal Rate of Return IRR The internal rate of return measures the rate of return the investment in the project is achieving.

It can be compared to the rate of return of the stock market or other investments. It facilitates the comparison of different. Calculate the following time value of money problems.

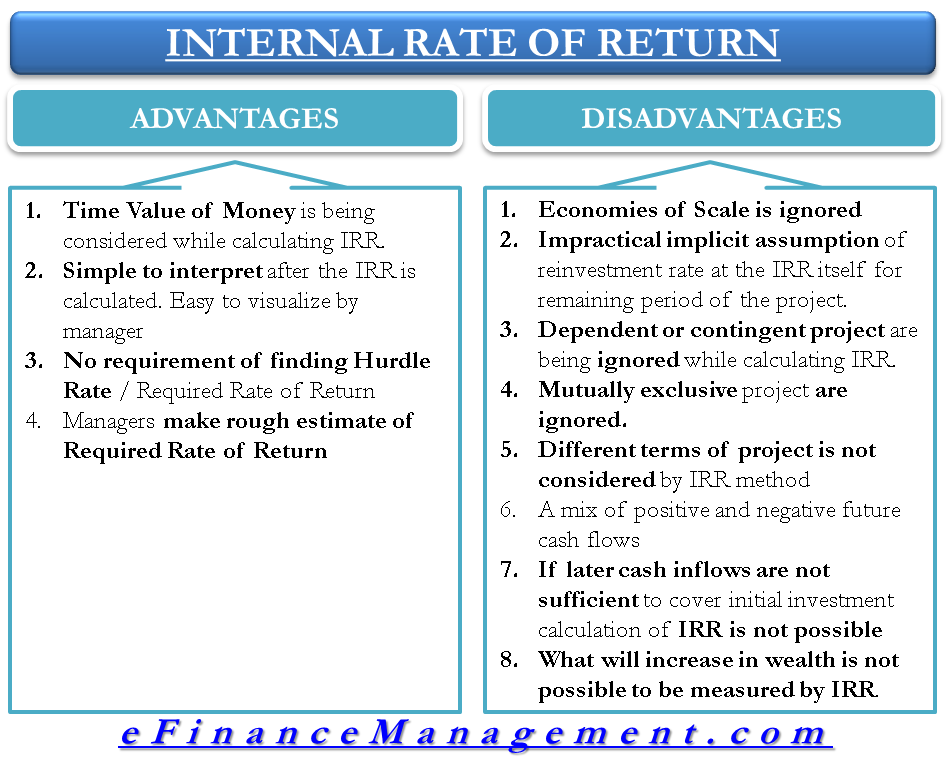

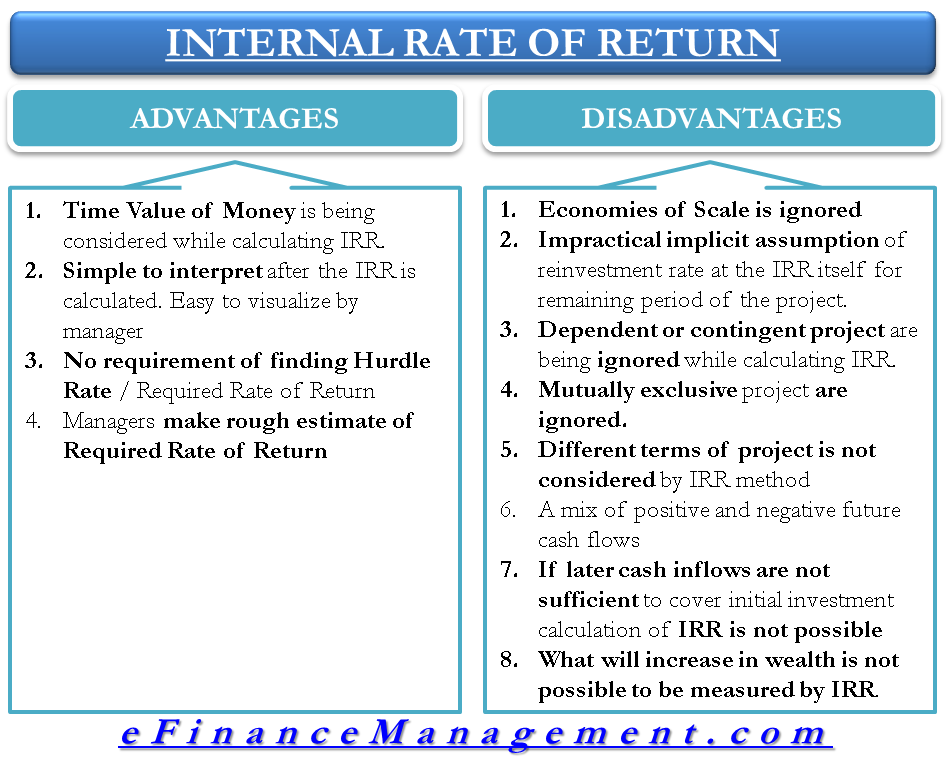

Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flowsDescribe the advantages and disadvantages of each method. Use the profitability index to prioritize independent capital investment projects. The internal rate of return IRR is a metric used in capital budgeting to estimate the return of potential investments.

Calculate the following time value of money problems. Describe the use of internal rate of return IRR net. Assume all payments are made at the end of the period.

Corporate Finance Create a 350-word memo to management including the following. Your company is looking at purchasing a new machine for the production facility. It is the discount rate at which the NPV of the project is zero.

Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows. The Internal Rate of Return IRR is the discount rate that makes the net present value NPV Net Present Value NPV Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present. Use the net present value method to analyze mutually exclusive capital investments.

Use present value and future value tables to incorporate the time value of money. What is the rate of return required to accumulate 400000 if you invest 10000 per year for 20 years. Any project with a negative net present value is rejected unless other factors dictate its acceptance.

Therefore we can use the variables to calculate the modified internal rate of return MIRR. IRR is a discount rate that makes the. Internal Rate of Return The discount rate for which the net present value is zero for a series of future cash flows after accounting for the initial investment.

Describe the advantages and disadvantages of each method. It is the discount rate at which the present value of a projects net cash inflows becomes equal to the present value of its net cash outflows. Describe the use of internal rate of return IRR net present value NPV and the payback method in evaluating project cash flows.

The Internal Rate of Return The IRR is defined as the discount rate that makes NPV 0. You have narrowed it down to two choices. The cost of capital is used as the discount rate when computing the net present value of a project.

Predict the internal rate of return and describe its relationship to net present value. If you want to accumulate 500000 in 20 years how much do you need to deposit today that pays an. Note that IRR does not describe the magnitude of return.

Purpose of Assignment The purpose of this assignment is to allow the student to calculate the project cash flow using net present value NPV internal rate of return IRR and the payback methods. According to Business Encyclopedia 2019 NPV and IRR are two methods for choosing between alternate projects and investments when the goal is to maximize shareholder wealth. The internal rate of return sometime known as yield on project is the rate at which an investment project promises to generate a return during its useful life.

Describe the use of Internal Rate of Return IRR Net Present Value NPV and the Payback Method in Evaluating Project Cash Flows. In other words it is the expected compound annual rate of return that will be earned on a project. That results in upfront required cash outflows to be equal to the present value of future cash inflows.

Like the NPV process it starts by identifying all cash inflows and outflows. Of a project zero. The IRR rule states that projects or investments.

We find that the internal rate of return on this piece of equipment is between 11 and 12 since our factor falls between those two. 1 on 10 is the same as 1 million on 10 million. Create a 350-word memo to management including the following.

If you want to accumulate 500000 in 20 years how. Describe the internal rate of return method.

Advantages And Disadvantages Of Internal Rate Of Return Irr Efm

0 Comments